Top Guidelines Of Tax Accountant In Vancouver, Bc

Wiki Article

Some Known Details About Outsourced Cfo Services

Table of ContentsThe Definitive Guide for Small Business Accounting Service In VancouverSmall Business Accounting Service In Vancouver Things To Know Before You Get ThisNot known Details About Cfo Company Vancouver The Facts About Vancouver Tax Accounting Company Uncovered5 Simple Techniques For Cfo Company VancouverThe smart Trick of Small Business Accountant Vancouver That Nobody is Discussing

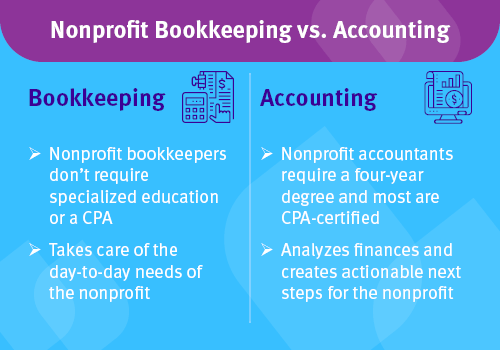

Below are some advantages to hiring an accountant over an accountant: An accounting professional can provide you a detailed sight of your company's monetary state, along with strategies and also recommendations for making financial decisions. Accountants are just accountable for taping monetary purchases. Accountants are required to complete more schooling, accreditations as well as job experience than accountants.

It can be difficult to evaluate the suitable time to hire an accounting expert or accountant or to figure out if you require one in all. While several local business employ an accountant as a professional, you have a number of options for taking care of financial tasks. Some tiny organization owners do their own bookkeeping on software their accounting professional suggests or makes use of, giving it to the accounting professional on a regular, regular monthly or quarterly basis for activity.

It might take some history research to discover an ideal accountant due to the fact that, unlike accounting professionals, they are not called for to hold a professional accreditation. A solid endorsement from a relied on coworker or years of experience are important variables when hiring an accountant.

The Greatest Guide To Vancouver Tax Accounting Company

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg)

For local business, adept money administration is an important aspect of survival as well as development, so it's important to function with a financial specialist from the start. If you like to go it alone, think about beginning out with accounting software as well as keeping your publications meticulously up to date. That way, need to you require to work with an expert down the line, they will have visibility into the full economic history of your service.

Some resource meetings were performed for a previous version of this short article.

The 5-Second Trick For Virtual Cfo In Vancouver

When it involves the ins and outs of taxes, accountancy and finance, nevertheless, it never hurts to have a knowledgeable specialist to look to for advice. A growing number of accounting professionals are also taking care of points such as capital projections, invoicing as well as human resources. Eventually, a lot of them are tackling CFO-like functions.visite site As an example, when it concerned getting Covid-19-related governmental funding, our 2020 State of Small Company Study located that 73% of local business owners with an accounting professional said their accounting professional's recommendations was essential in the application procedure. Accounting professionals can also assist organization owners stay clear of pricey errors. A Clutch study of small company proprietors programs that greater than one-third of little businesses listing unanticipated expenditures as their top economic obstacle, complied with by the blending of organization and individual financial resources and the inability to receive repayments in a timely manner. Small company owners can expect their accountants to aid with: Picking the organization structure that's right for you is crucial. It impacts just how much you pay in taxes, the documents you need to submit as well as your personal responsibility. If you're wanting to convert to a various company structure, it could cause tax effects browse this site and various other issues.

Even business that are the same dimension as well as market pay really different quantities for bookkeeping. These expenses do not transform right into money, they are essential for running your business.

The Tax Consultant Vancouver Ideas

The average price of audit services for tiny organization varies for each one-of-a-kind circumstance. The typical monthly bookkeeping costs for a small business will climb as you add more solutions and the tasks obtain tougher.You can record purchases and process pay-roll utilizing on the internet software application. You enter amounts right into the software, and the program computes totals for you. In some cases, payroll software for accounting professionals enables your accountant to use payroll processing for you at really little extra expense. Software services come in all sizes and shapes.

Vancouver Accounting Firm Things To Know Before You Buy

If you're a brand-new company proprietor, don't forget to factor audit costs right into your spending plan. Administrative prices and accounting professional costs aren't the only accounting expenses.Your time is likewise beneficial as well as should be considered when looking at accountancy costs. The time spent on audit jobs does not produce earnings.

This is not planned as legal advice; for additional information, please click here..

Excitement About Outsourced Cfo Services

Report this wiki page